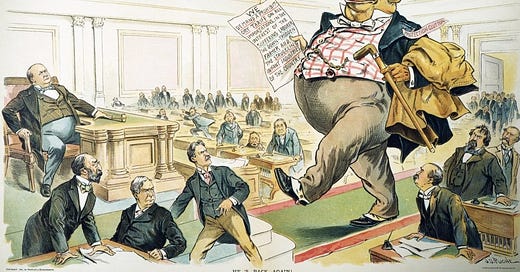

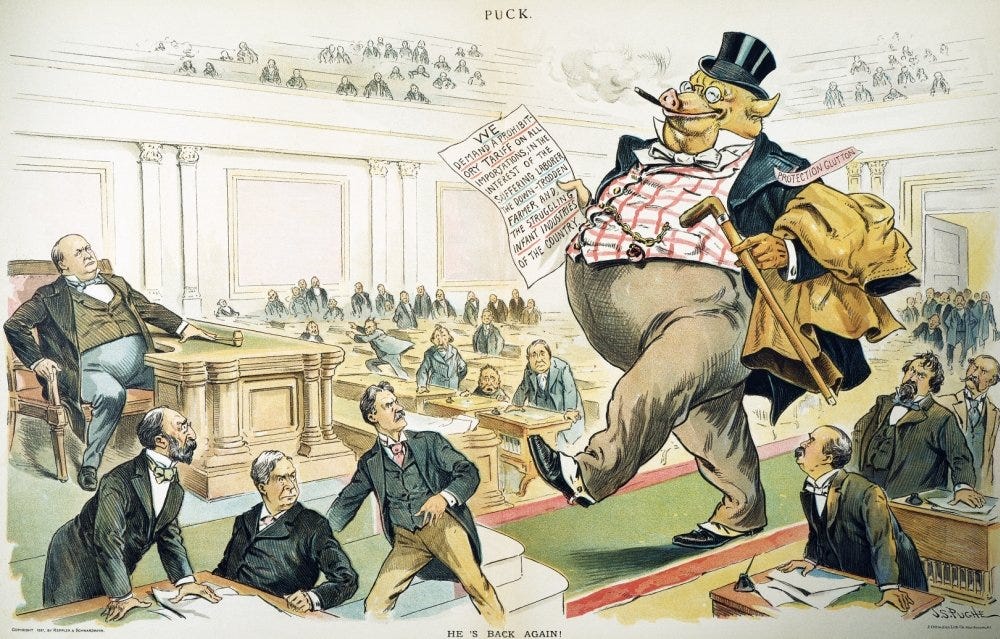

This week Donald Trump began his second term as President. Although we don’t know exactly what he will do in terms of international trade, he has spent the past year calling himself ‘Tariff Man’. He has pointed out that in the early years of the United States it had high tariffs, virtually no other taxes, and high growth. As such, he claims that tariffs helped to make America Great and will make America great again. So, the question must be asked: is the President correct?

President Trump is correct in that tariffs were utilised in the early stages of America’s development and that this did coincide with the nation’s growth. However, this does not necessarily mean that tariffs were the reason for such high growth. In fact, much of America’s rapid growth was down to the fact that it was a large nation which was not only blessed with an abundance of natural resources but also allowed for free trade between individual states.

Moreover, there is evidence from America’s history which suggests that increasing tariffs and embracing protectionism was actually damaging for the United States and its citizens. While protectionism did not cause the Great Depression, the Smoot-Hawley Tariff Act certainly did exacerbate it and so compounded the misery faced by ordinary Americans. While the Act was well intentioned and designed to protect Americans, it saw imports of essential goods plummet while the value of exports also declined. This increased prices for households and destroyed jobs and so it was ordinary Americans who bore the cost.

What is more, while it is true that the US did rely on tariffs when it was a young nation this is not surprising as this is what countries often do in the early stages of their development. It is what a desperate government does when all it can really do is control and enforce its border and lacks the means to collect other taxes. As countries develop they tend to reduce tariffs and move towards less economically damaging taxes. If one looks at the effective tariff rates around the world, the policies proposed by President Trump would put the United States among the very poorest and most dysfunctional countries in Africa, South America, and Asia. I’m personally not sure that is what he meant when he said that he wants to make America great again.

The reason why nations tend to move away from high tariffs and towards other forms of taxation – as the United States did – is because tariffs cause greater economic distortions and so are far less efficient at raising revenue than other taxes.

Tariffs do raise revenue for the government but they do so at great cost. They increase costs for consumers as they face higher prices. They also mean that US firms face higher prices for when they buy the goods they need to make their products. Moreover, hiking tariffs tend to lead to trade wars. If the US increases tariffs on imports from a certain nation then that country will almost always respond by slapping retaliatory tariffs on goods from the US. All of this hurts US firms and places American jobs and livelihoods in jeopardy.

Furthermore, President Trump has stated that part of his rationale for increased tariffs is to reduce the nation’s reliance on imports in order to strengthen its industrial base and support jobs. That within itself is a weak argument for increasing tariffs for the reasons discussed above.

However, assuming that increasing tariffs did work then that would see imports decrease and would mean that the Federal Government received less revenue. Given that President Trump has stated that he wants to use this increased revenue as cover to cut other taxes then this clearly cannot work. Increased tariffs which lead to a decline in imports which will mean that there is less money coming in to fund public spending. The government will have no choice but to increase borrowing which will increase the deficit and so would be incredibly irresponsible.

President Trump is right to be concerned about the impact of taxes on US firms and households. They do have a negative impact on economic growth and increase the cost of living on Americans. Unfortunately cutting taxes and replacing them with higher tariffs simply will not work. The only fiscally sustainable way to reduce the tax burden on working Americans is through spending cuts. Hiking tariffs in order to slash other taxes will do nothing to improve the plight of ordinary Americans and will almost certainly exacerbate their problems. Tariffs did not make America great and they will not make America great again.

Thanks as ever for reading. Have a great weekend!